Climate change is one of the most pressing issues of our day. The effects are already being felt in several parts of the world and there’s growing demand for organisations to align their operations with more sustainable practices.

Even though the current understanding of the potential financial risks posed by climate change is still at an early stage, investors – and the public – want to know what organisations are doing to mitigate climate related risks, what their goals towards a more sustainable path are and what they are doing to get there.

Several climate-related disclosure standards have been developed in response to the increased need for decision-useful climate-related information, such as GRI, SASB, CDP and many others. However, many of the existing standards focus on climate-related data and other sustainability measures. The lack of information on the implications of climate-related risks for an organization’s business is frequently cited as a critical gap by users of these disclosures.

Since 2017, the industry-led Task Force on Climate-related Financial Disclosures (TCFD) has been publishing recommendations for more effective, voluntary disclosure of climate-related risks and opportunities.

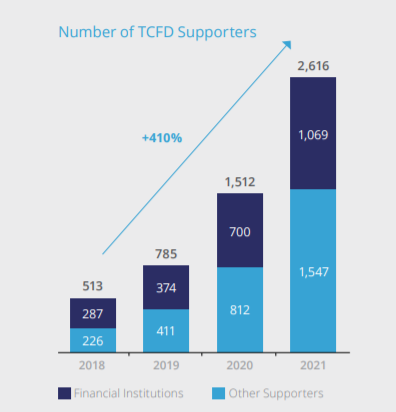

In recent years, the number of TCFD supporters has grown exponentially, bringing the supporter count to over 2,600 globally in 2021. Organizations supporting the TCFD span nearly 89 countries and almost all sectors of the global economy.

In October 2021, the UK Government determined that large UK-registered companies will have to disclose climate-related financial data from April 2022. The UK is the first G20 country to enshrine the mandate into law, subject to Parliamentary approval. Other countries like New Zealand and Switzerland have begun working on making TCFD-aligned disclosures mandatory across relevant sectors as well.

Mandatory or not, disclosing this type of information to your investors is becoming increasingly important with an growing number of funds and investors requiring strong ESG credentials before agreeing to deploy capital.

Here are eight steps to lay the groundwork for implementing TCFD Recommendations:

1 – Understand the TCFD Recommendations and Guidance

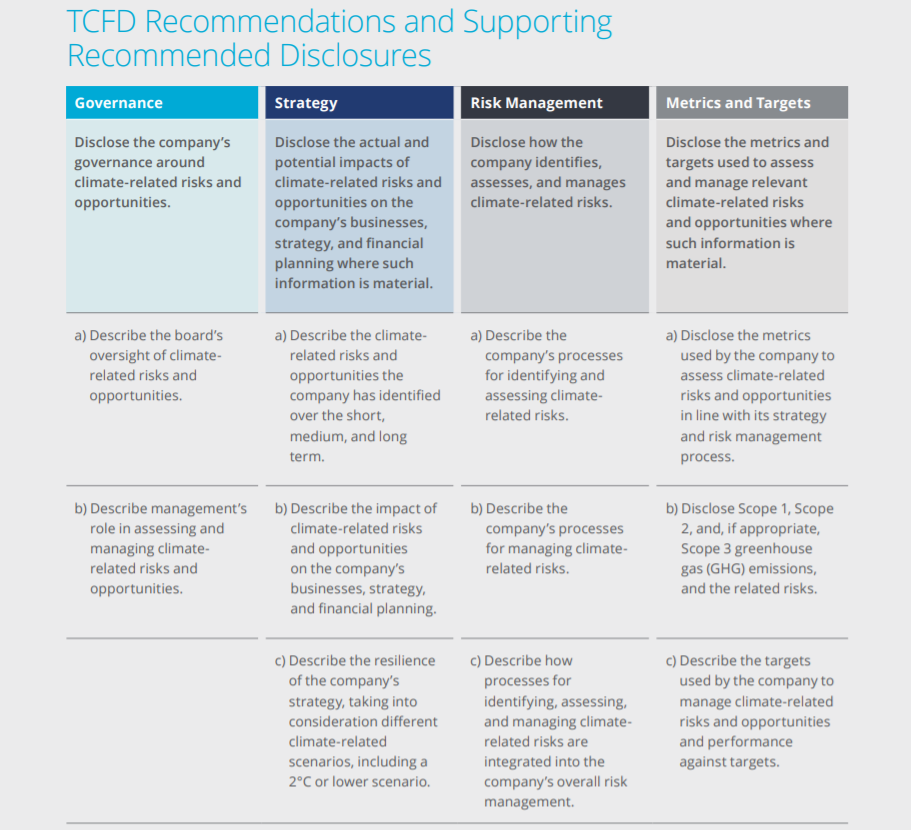

The Task Force structured its recommendations around four thematic areas that represent core elements of how organizations operate—governance, strategy, risk management, and metrics and targets.

The table below is a summary of what they suggest your organisation should disclose to investors:

2 – Identify the organisation’s industry (or industries)

While the disclosures are aimed for all industries, the TCFD provides supplemental guidance for these sectors:

- Financial Sector. The Task Force created supplemental recommendations for the financial sector, which it divided into four broad categories depending on the kind of activities carried out. The four industries are as follows:

- Banks (lending)

- Insurance companies (underwriting)

- Asset Managers (asset management)

- Asset Owners, which include public- and private-sector pension plans, endowments, and foundations (investing).

- Non-Financial Groups. Non-financial businesses, which account for the majority of GHG emissions, energy use, and water use. These businesses were divided into four categories:

- Energy

- Materials and Buildings

- Transportation

- Agriculture, Food, and Forest Products

If your organisation is not under the sectors listed above, it might still be useful to review and consider the issues and topics contained in the supplemental guidance.

3 – Set the Tone at the Top and Define Roles

Much of what the Task Force recommends is focused on good governance practices. Direct monitoring and executive leadership are required for effective management of climate-related risks and opportunities and those efforts need to come from the board of directors first. Key climate-related elements should be recognised, examined, measured, controlled, and reported as any other business-critical issue by leadership setting the tone at the top.

WBCSC noted in a recent analysis that lack of communication and knowledge of mutual roles across different teams is one of the causes behind the notable mismatch between what sustainability functions in organisations regard to be material hazards to their business and the risk management and legal teams’ processes and procedures. Defining what everyone is responsible for is crucial.

4 – Decide Where the Information Will be Disclosed

The Task Force recommends that organizations provide climate-related financial disclosures in their mainstream (i.e., public) annual financial filings. Public companies in most G20 jurisdictions are required by law to disclose material information in their financial filings, including material climate-related information.

However, there is more flexibility for voluntary disclosures and sustainability reporting can be done in regulatory filings, integrated reports, sustainability reports, earnings presentations, investor relations websites, among others. The main aspects to consider in this decision are shareholder feedback and the advice of your financial reporting, legal, and compliance teams.

5 – Adapt Existing ERM Practices to Account for Climate Risk

Managing climate-related risks needs to be a part of your routine risk management activities. In this article, we talked about some risk categories to consider. There’s also guidance available on how to apply enterprise risk management to environmental, social and governance-related risks using the COSO Framework, for example. If your organisation’s Risk Management Framework is already aligned with this standard, integrating ESG risks should be intuitive.

If you are not currently performing Risk Management in your organisation and would like to start, IRIS Intelligence offers a range of introductory, intermediary and advanced courses. More information can be found here.

6 – Perform Materiality Assessment

While Governance, Strategy and Risk Management are a big part of the Task Force’s recommendations, it is also proposed that you set Metrics and Targets to reduce your organisation’s impact on the environment. When defining which metrics to disclose and your targets for them, organisations need to determine whether they are material or not. Materiality is the criteria that defines which relevant issues are important enough to warrant reporting on.

There are several aspects to consider when performing a materiality assessment. According to the GRI Sustainability Reporting Standards:

“A combination of internal and external factors can be considered when assessing whether a topic is material. These include the organization’s overall mission and competitive strategy, and the concerns expressed directly by stakeholders. Materiality can also be determined by broader societal expectations, and by the organization’s influence on upstream entities, such as suppliers, or downstream entities, such as customers. Assessments of materiality are also expected to take into account the expectations expressed in international standards and agreements with which the organization is expected to comply. These internal and external factors are to be considered when evaluating the importance of information for reflecting significant economic, environmental, and/or social impacts, or for stakeholders’ decision making.”

We also recommend reading the Guidance on Metrics, Targets, and Transition Plans for help identifying metrics for your organisation to report on.

7 – Consider Performing Scenario Analysis

The Task Force recommends that organisations use Scenario Analysis to properly incorporate the potential effects of climate change into their planning processes. Organizations must consider how climate-related risks and opportunities may evolve, as well as their potential business implications under various conditions. Scenario analysis assesses a variety of hypothetical possibilities by considering several plausible future scenarios under a set of assumptions and limitations.

Even though the use of Scenario Analysis is recommended by the Task Force, they understand the challenges organisations face, especially in a business or investment context, as data availability and granularity can be an issue. Therefore, organisations should start simple and evolve their analysis as more information becomes available.

IRIS Software

Scenario analysis can be modelled within the IRIS Intelligence software and allows simple data collection to create a basic model which can be developed over time, increasing sophistication of the model based on the needs of the organisation. Want to learn more about the IRIS software?

8 – Make sure the data follows the principles for Effective Disclosures

When developing climate-related financial disclosures, the Task Force advises organisations who follow its proposals to keep these principles in mind:

- Disclosure should represent relevant information

- Disclosure should be specific and complete

- Disclosure should be clear, balanced, and understandable

- Disclosure should be consistent over time

- Disclosure should be comparable among companies within a sector industry or portfolio

- Disclosure should be reliable, verifiable, and objective

- Disclosure should be provided on a timely basis

The principles are intended to help firms understand the connections and relationships between climate-related concerns and their governance, strategy, risk management, metrics, and targets.

TCFD has released several publications since its original recommendations. We suggest starting with a quick overview, followed by the original Recommendations of the Task Force on Climate-related Financial Disclosures (2017) and finally the latest 2020 update.